Getting solar power has never been easier or cheaper. According to the U.S. Department of Energy, installing solar panels on your home costs nearly 23 percent less in 2019 than it did in 2014. That, along with record-setting panel efficiencies, bodes well for homeowners who can now find solar panels at reasonable costs, as well as more generous financing options. Loans, leases, power purchase agreements and even discounts for outright purchases have more homeowners looking to the power of the sun for their energy needs.

Finding the right financing option for your home might seem daunting, but it doesn’t have to be. Read on to discover the wide variety of options available to you.

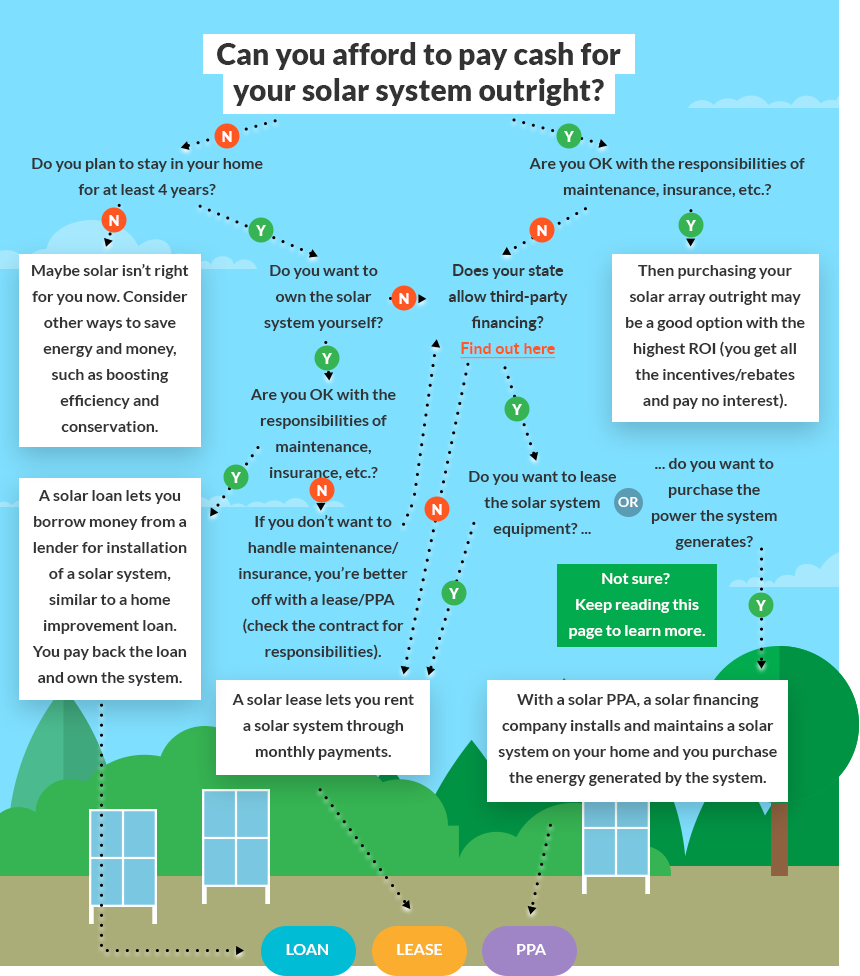

Quick Guide to Paying for Solar

The expanding popularity of solar power has prompted new financing opportunities for homeowners. Today there are three popular ways to finance a solar array: loan, lease or power purchase agreement. For those with ample savings, an outright purchase of solar panels is also a good option. Here’s what homeowners can expect from each:

This usually requires anywhere from $15,000 to $30,000 in up-front costs, but it also provides the broadest opportunity for tax incentives, rebates, discounts, and savings. Though the homeowners start saving on utility bills almost immediately, they are also responsible for maintaining the system through the years.

Loans through a bank will provide the homeowner with the financial means to set up the solar system. Just as with a home improvement loan, the homeowner might pay nominal up-front costs for opening the loan, and will then repay the loan on a monthly basis. Again, the homeowner is responsible for maintenance.

In a lease, the homeowner allows a developer to install and maintain a solar array on the home. The developer owns the solar panels, and the homeowner uses the power produced in exchange for a series of scheduled payments. Essentially, the homeowner is renting the solar panels. The developer is responsible for maintenance.

In a PPA, the homeowner allows a developer to install and operate a solar system on the property. The homeowner then purchases the power produced at a fixed rate for each kilowatt per hour. The developer owns the panels and is responsible for maintenance; the homeowner simply pays for power. PPAs are not available in all states.

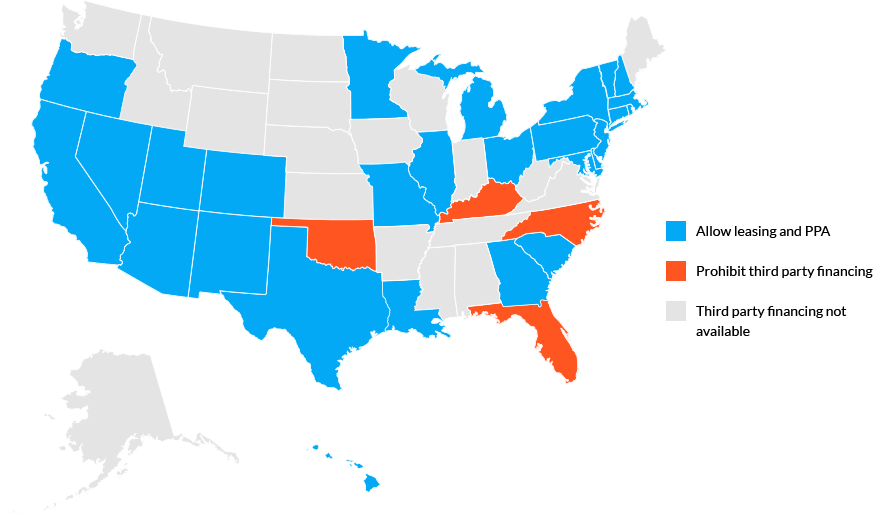

Does Your State Allow Third-Party Solar Financing?

Many states allow third-party financing through lease or PPA. About 84 percent of all U.S. residential solar power was owned by third parties in 2016, to the U.S. Energy Information Administration. In some states, third-party financing is allowed in only certain sectors or for systems that meet a size requirement. Currently, seven states – Alabama, Florida, Kansas, Kentucky, North Carolina, South Carolina, and West Virginia – do not allow PPAs, but that could change as more homeowners express a desire for flexible solar power options.

Source: U.S. Department of Energy and DSIRE

Self Assessment: Solar Financing and You

Purchasing solar panels and systems is a big decision; the choice of financing might be an equally huge commitment, as it’s a large chunk of money for any homeowner. Making the choice depends on many factors, including your financial situation, the extent of the solar system you prefer, what will work best with your particular home or site, and what the state or area allows when it comes to various types of financing. This question and answer section gives homeowners a visual layout of choices that might help make the final decision easier.

Breakdown: Solar Panel Finance Options

The financing a homeowner chooses for a solar array depends greatly upon who owns the system. Homeowners who purchase outright, with cash, or those who choose to obtain a loan for panels actually own the system; those who enter into third-party agreements, such as a lease or PPA, do not own the system. Who owns the solar panels is an important point because that determines the financial implications – the upfront cost, maintenance, terms of contracts, savings, return on investment, rebates and more. The following chart breaks down the financing options.

| Purchase | Loan | Lease | PPA | |

|---|---|---|---|---|

| Who owns it? | Homeowner | Homeowner | Third-party | Third-party |

| Who gets rebates? | Homeowner | Depends, but usually the homeowner | Third-party | Third-party |

| Up-front costs | Full purchase price of system, minus any up-front rebates | Loan closing fees | None, or a down payment option that lessens the monthly fees | None, or pre-purchase plan; check contract for details |

| Monthly costs | None | Monthly loan payments | Monthly or quarterly lease payments | Monthly energy payments |

| Length of agreement | None | The length of the loan, generally between 10 and 30 years | Contracts vary, but typically 20 years | Varies, but typically 10-25 years |

| Who pays insurance? | Homeowner | Homeowner | Third-party (though some contracts vary) | Third-party (though some contracts vary) |

| Who does maintenance? | Homeowner (self-maintenance or contracted) | Homeowner (self-maintenance or contracted) | Third-party | Third-party |

| Qualification guidelines | None | Loan qualification guidelines vary depending on state, financial situation and overall plans; check with lender for details | Depending upon the contract, good credit might be a factor, as could other financial situations. | Depends upon state guidelines; not all states allow PPAs. Those that do often have restrictions on who qualifies. |

| State availability | Everywhere | Everywhere, though some states might impose restrictions on who can underwrite the loan | In select states or regions; lease companies do not operate in all states | Kentucky, Oklahoma, North Carolina, South Carolina and Florida do not allow PPAs |

| Options for sale | No limitations | No limitations; the solar loan is usually handled just as any home improvement or equity loan upon sale of a property | Depends on contract; typically, buyer must accept and qualify for the contract; if not, seller must buy out remainder of agreement. | Depends on contract |

Keep in mind that these are generalities; each point of loans, leases and PPAs are determined by individual qualifications, terms and conditions. Always compare contracts for details, and ask for professional advice before entering into any agreement.

What’s the Payback on Various Solar Panel Financing Options?

A solar system will typically save the homeowner on electricity costs, sometimes cutting the utility bill in half or more. However, the financing options could affect just how much money comes back to the homeowner. Though the final numbers vary from one state to the next, and possibly even from one city to the next, this example shows the general trends in payback for solar systems, depending upon the financing option chosen.

| Purchase | Lease or PPA | Loan | |

|---|---|---|---|

| How it works | Purchasing the system outright means that the homeowner carries the burden of up-front costs, but also receives all rebates and incentives. | PPAs are available in some states; leases are available in all states. Each option offers homeowners the option of using the energy produced by solar panels but they do not own the equipment. | This option allows homeowners to purchase the equipment but do so with little to no up-front costs; they usually will be able to reap rebates and incentives. |

| Up-front costs | $$$$ | $ | None |

| Monthly payments | None | $$$ | $$ |

| Tax credits or rebates | $$$ | None | $$$ |

| 20-year benefit | $$$$ + Clean Energy Boost | Clean Energy Boost | $$ + Clean Energy Boost |

| Home value change | $$ | Negligible | $ |

The advantages of purchasing a system outright or through a loan are easy to see. However, though there are monetary advantages to leasing and PPAs, the savings might vary depending upon numerous factors, such as escalator clauses, whether a flat-rate is chosen for PPA energy costs, and how long the lease or PPA contract is in force.

Though the home value change can be tough to quantify, there are some numbers that can put it in perspective:

Of course, your mileage may vary; ask your solar representative for numbers that give you a good sample of homes in your area that have solar power arrays of the same size you intend to invest in.

When it comes to home value change, solar panels that are purchased outright or via loan are much easier to transfer to the new owners, which creates a boost to home value. When it comes to leases or PPAs, the new buyers will have to assume the agreement, which they might not want to do – or in some cases, might not qualify to do. This might mean that selling a home that has a lease or PPA contract in force could be tougher, thus negating any extra value that might otherwise be obtained by the addition of solar panels.

Easy Money:

Solar Rebates and Tax Incentives

One of the perks of solar panels is the possibility of rebates and tax incentives. In fact, homeowners can reduce the up-front cost of solar panels by anywhere from 30 to 50 percent, depending upon the variety of rebates, tax credits and tax incentives that might come into play. Those incentives can vary widely depending upon the state and a homeowner’s personal tax situation. For instance, homeowners in California may qualify for any number of 75 different photovoltaic policies and incentives, while those in Tennessee have only 10 solar discounts for which they may qualify.

For those on the fence about solar panels, tax credits and rebates might be the factor that makes their decisions easier. Tax credits are available through federal, state and local governments; for example, the current federal tax credit for solar panels is 30 percent, available through 2019. For more in-depth information on tax incentives and rebates, visit the links below:

Free Panels:

Can You Go Solar for Nothing?

In the online search for solar panel information, eventually every homeowner sees these magic words: “Get solar panels for free!” But as with anything else in life, if it seems too good to be true, it probably is.

In most cases, this is marketing speak for a lease: A qualified contractor shows up and does install solar panels, free of charge. However, once those panels are installed, the homeowner has to lease them from the company in order to use them. The panels were technically “free,” but the homeowner does not own the panels and still has monthly payments required to have power.

Learn More About Free Solar PanelsEXPERT TIPS: Six Things to Consider for Your Unique Solar Financing Situation

The best options for solar financing depend on several factors, including the state in which the homeowner lives, the financial situation (such as down payments or credit history), anticipated savings per month, the layout of the site and more. Here are a few points that homeowners should keep in mind when deciding which financing options might work best for solar systems.

Though you might use well more than $100 per month in electricity today, will that be the case when life changes over the next few decades? For instance, those who have children about to leave the nest might see their bills drop dramatically. In some cases, more efficient large appliances – such as a much more efficient furnace or HVAC unit – could lead to an electricity drop that makes solar panels less necessary.

Those who are choosing a solar system with the intention of selling their excess energy back to the electric company should be aware that terms can change, meaning that their investment doesn’t give them the return they hoped. For instance, Nevada energy providers in late 2015 set new rules that tripled monthly fees while cutting customer payments for surplus power from 11 cents to 2 cents per kilowatt hour, leaving many homeowners with serious financial liability.

Leasing, PPAs and buying outright all have pros and cons. For instance, “leasing may be a good alternative in that you won’t be stuck with technology that is outdated at the end of the lease,” said Michael Kowal, an energy attorney. “There may be fewer upfront costs with this option as well. However, the homeowner needs to have an understanding of all of the costs to make sure that he or she isn’t paying more than the revenue generated (especially on an after-tax basis).”

Your utility company offers set rates, but sometimes those rates are in “tiers” of usage. The tier you fall into can help determine your actual costs. Typically, those with higher energy use fall into higher rates, but this is not always the case. Know what your costs are, and how that tier affects your return on investment.

“In general, homeowners need to be able to take advantage of the 30 percent Solar Investment Tax Credit,” said Tor Valenza, the chief marketing officer of solar at Impress Labs. “A tax credit is like a gift card for paying the IRS. So in order to use it, you have to actually owe taxes. For example, if your solar system costs $12,000, you’ll get a $3,600 tax credit. But if you only owe $1,000 in 2016, you won’t get a refund for $2,600. However, you will be able to carry over the balance of $2,600 for five years.”

Before opting for any solar system, speak to your tax advisor about what tax credits and incentives you might get. For example, some homeowners might get less than the maximum rebates because they don’t fall into a required income bracket. Also remember that there are local incentives that might vary by state or municipality; a tax expert can help you find all the available financial help out there.