Grants are funding given to promote renewable energy that does not have to be paid back.

Qualifying groups include low-income or rural homeowners, farms, Native American tribes, schools, and nonprofit organizations.

A Federal Housing Administration loan is a low-cost loan to help homeowners install energy saving upgrades to their homes or purchase a new home that is energy efficient. To qualify, you need a minimum credit score of 660, a maximum total debt-to-income ratio of 45 percent, a maximum combined loan-to-value (market value of the home divided by first mortgage loan balance and PowerSaver) of 100 percent. One-unit, owner-occupied, principal residence properties only.

An Energy Efficiency Mortgage is a loan that rolls into your existing mortgage. It is secured through traditional lending companies, insured by FHA or VA. People who qualify include mortgage holders, individuals who may not qualify for competitive interest rates with private lenders, and veterans.

Property types include one to four units existing or new construction.

Harnessing solar energy – while having numerous long-term benefits – can be an expensive undertaking. The following guide will help current and future homeowners understand federal financing options available to them. The U.S. government is committed to renewable energy projects, and with good reason. Some of the ways its investment helps the United States as a whole include:

Moving away from finite fossil fuels and helping the country to become energy independent

Improving the environment by reducing CO2 emissions

Harnessing the infinite nature of solar energy

Creating more jobs within industries focused on energy efficiency

Developing partnerships to create more opportunities for renewable energy in federally assisted housing

Expanding the number of renewable energy megawatts

To facilitate all of the benefits listed above, the U.S. government currently offers a 30 percent Investment Tax Credit (ITC) of the cost of the system you install. The ITC will be 26 percent by 2020, and then 22 percent by 2021. In addition to this rebate, qualified individuals can take advantage of even more savings programs. Federal grants are a perennial favorite across the board given that they don’t need to be repaid, while federal loans and mortgages often offer fixed interest rates much lower than those available from private lenders. Keep reading to learn more about federal financing options.

Solar Grants: Funding Communities

In an effort to incentivize the growth of solar power, various departments within the federal government offer grants to make the transition more affordable. No typical residential solar energy grants are given directly at the federal level; instead, the departments provide grants to low-income and rural areas alongside farms, tribes, schools, and nonprofit organizations.

With the average lifespan of a solar panel reaching beyond 20 years and electric bills being dramatically reduced or eliminated altogether, these grants offer cost-saving measures for those who need them most.

Where Can You Find Department of Energy Solar Grants?

It should be no surprise that the best place to find federal grants is by researching federal departments – specifically the U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy. This website provides an exhaustive database of both current and past opportunities, allowing individuals to familiarize themselves with the grant format and eligibility requirements. Users can also sign up for an e-mail reminder whenever new grants are released. Some of the main grants include:

U.S. Department of Housing and Urban Development

Operating under HUD, the Office of Affordable Housing Preservation works with homeowners in low-income areas to fit and provide upkeep for alternative energy sources, such as solar panel systems. Funds are disbursed via a $250 million budget provided by the Housing Recovery Act and must be spent within two years of receipt.

U.S. Department of Energy

Funding offered through the DOE’s Office of Indian Energy Policy and Programs is geared toward helping tribes pursue technology- and fuel-neutral projects. Through $15 million in new investments, tribes can request support to install energy generating systems or energy efficiency measures for tribal buildings; community-scale energy generating systems or energy storage on Tribal lands; energy infrastructure and integrated energy systems to electrify Tribal Buildings, and other energy-related infrastructure initiatives.

U.S. Department of Agriculture

Providing grants of up to $20,000, the Rural Energy for America Program helps farmers and small rural businesses obtain and install renewable energy systems. Recipients may also use the grant to make improvements to existing energy efficiency systems. Agricultural producers must demonstrate that at least half of their gross income comes from agribusiness and show they can pay for at least 75 percent of the project to qualify.

U.S. Department of Agriculture

The USDA created these grants to assist rural communities to improve the generation of energy in areas with abnormally high energy costs. Funds can be used to acquire, construct, install, repair, replace, or improve systems that improve energy creation and distribution, be they on or off-the-grid.

U.S. Department of the Treasury

Also known as the 1603 Program, this incentive reimburses applicants for some of the cost of installing a solar system in lieu of tax credits. Payments are made only after the system has been placed in service, meaning individuals will need to have enough funds on hand to pay for the system and its installation initially.

Solar Loans:

The FHA’s PowerSaver Program

There are a number of home equity loans available to help offset the cost of outfitting a house with solar panels. These loans essentially work as equity loans, creating a lien against the house and reducing its equity. Because of how the loans are structured, homeowners can likely save more on their electric bills than they will have to pay in loan payments, making them a very good deal (particularly when you add in the 30 to 22 percent tax credit available):

-

Interest rates range from 3.5 to 7.5 percent

-

Terms are typically 7 to 20 years

-

Interest may be tax-deductible

Some of the most common types of solar energy loans are:

FHA PowerSaver U.S. Department of Housing and Urban Development

Created by the Federal Housing Administration, the PowerSaver helps individuals make cost and energy effective improvements to their homes, including the installation of solar power systems. Homeowners are eligible to borrow up to $25,000 and have as long as 20 years to make any energy improvements approved by FHA and HUD. Eligible options include both solar PV and thermal systems. The FHA guarantees up to 90 percent of the loan, which will be provided through a private lender. Homeowners with an FHA 203(k) first mortgage are also eligible to take advantage of the PowerSaver program, either when purchasing or refinancing a home. Applicants should have a credit score of at least 660 and be prepared to pay a fixed interest rate ranging from five to 10 percent. A map of qualified PowerSaver lenders is shown below.

-

Lender

State Availability

Contact Information

Description

-

This type of loan is for smaller projects such as insulation, air and duct sealing, water heating, and upgrading or replacing heating and cooling equipment. This is an unsecured consumer loan—no home appraisal is required.

-

This type of loan is for smaller projects such as insulation, air and duct sealing, water heating, and upgrading or replacing heating and cooling equipment. This is an unsecured consumer loan—no home appraisal is required.

-

This type of loan is for smaller projects such as insulation, air and duct sealing, water heating, and upgrading or replacing heating and cooling equipment. This is an unsecured consumer loan—no home appraisal is required.

-

Arizona, California, Colorado, Florida, Minnesota, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Tennessee, Texas, Utah, Washington, Wisconsin

This loan is for home purchase or refinance. It can be used for energy efficiency improvements as part of an FHA 203(k) rehabilitation first mortgage when purchasing a home or refinancing an existing mortgage. For loan limits visit, https://entp.hud.gov/idapp/html/hicostlook.cfm

-

Arizona, California, Colorado, Connecticut, Florida, Hawaii, Kansas, New Jersey, New Mexico, North Dakota, Oregon, South Dakota, Texas, Utah, Washington

This loan is for home purchase or refinance. It can be used for energy efficiency improvements as part of an FHA 203(k) rehabilitation first mortgage when purchasing a home or refinancing an existing mortgage. For loan limits visit, https://entp.hud.gov/idapp/html/hicostlook.cfm

-

This loan is for home purchase or refinance. It can be used for energy efficiency improvements as part of an FHA 203(k) rehabilitation first mortgage when purchasing a home or refinancing an existing mortgage. For loan limits visit, https://entp.hud.gov/idapp/html/hicostlook.cfm

-

Larger retrofit projects that may include energy efficiency, solar PV, solar hot water, geothermal, or other renewable energy projects can be financed with this type of loan.

-

Arizona, California, Colorado, Connecticut, Florida, Hawaii, Kansas, Nevada, New Jersey, New Mexico, North Dakota, Oregon, South Dakota, Texas, Utah, Washington

Larger retrofit projects that may include energy efficiency, solar PV, solar hot water, geothermal, or other renewable energy projects can be financed with this type of loan.

-

Arkansas, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Illinois, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Nebraska, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Oklahoma, Oregon, Pennsylvania, South Carolina, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin

Larger retrofit projects that may include energy efficiency, solar PV, solar hot water, geothermal, or other renewable energy projects can be financed with this type of loan.

-

Kentucky, Maine, Minnesota, Nebraska, New Hampshire, New Jersey, New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, Virginia, Wyoming

Larger retrofit projects that may include energy efficiency, solar PV, solar hot water, geothermal, or other renewable energy projects can be financed with this type of loan.

-

California, Oregon, Washington

Larger retrofit projects that may include energy efficiency, solar PV, solar hot water, geothermal, or other renewable energy projects can be financed with this type of loan.

-

Arizona, California, Colorado, Florida, Nevada, New Jersey, New Mexico, Oklahoma, Oregon, Texas, Utah, Washington, Wisconsin

Larger retrofit projects that may include energy efficiency, solar PV, solar hot water, geothermal, or other renewable energy projects can be financed with this type of loan.

-

Larger retrofit projects that may include energy efficiency, solar PV, solar hot water, geothermal, or other renewable energy projects can be financed with this type of loan.

Multi-family Housing Loan U.S. Department of Agriculture

The USDA created this loan for rural rental housing for very low, low, and moderate-income families in addition to elderly individuals and those with disabilities. In addition to providing direct mortgages, the program also provides loans for owners looking to implement solar energy systems within rural areas. There is a 30-year payback .

Rural Utilities Service Electric Program U.S. Department of Agriculture

Operating as a loan and loan guarantee service, the RUSE program finances the construction, transmission, and generation of renewable energy systems, among others. While not open to individuals, corporates, states, territories, municipalities, people’s utility districts and nonprofits are able to apply. The amount available depends on the specific loan application.

Calculate Solar Value

Get help securing a loan for solar panels. The PV Value tool at PVValue.com helps calculate energy production value for photovoltaic systems. Homeowners and home appraisers can visit the site to find out what solar home improvement will be worth.

Energy Efficient Mortgages:

Are They Worth It?

Homeowners looking to make their homes more energy efficient are increasingly turning toward energy mortgages offered by the federal government. Whether improving the energy efficiency of a current home or purchasing a property that is already more energy-efficient, this type of funding has the ability to empower a vast range of both current and future homeowners. The federal government currently offers three types of energy-efficient mortgages, including:

How the mortgage works

Borrowers approved for this loan can add up to 100 percent of the cost of energy efficiency home improvements to an existing mortgage loan. Loans are made through private lenders but insured by the FHA. Although the loan previously had a maximum amount of $8,000, the ceiling is now set by finding the lesser of 5 percent of:

-

The value of the property

-

115 percent of the median area price for a single-family house

-

150 percent of the Freddie Mac conforming loan limit

Who qualifies

Individuals who meet the FHA’s income requirements outlined in Section 203(b) and make monthly mortgage payments are eligible. Victims of presidentially declared disasters are also eligible, though all applicants must live in a one-unit detached house. Homeowners must make a down payment of at least 3.5 percent.

What it covers

Closing costs, up-front mortgage insurance premium, efficiency improvements

What’s the benefit

The FHA’s EEM specifically helps individuals who otherwise may not be able to qualify for a conventional loan at a competitive interest rate, or who are residents of low-income neighborhoods, empowering them to better their properties.

How the mortgage works

Offered in conjunction with the VA Home Loan Guarantee Program, qualified applicants can borrow up to $3,000 if they only submit documents showing costs or contractor bids, or up to $6,000 if they can show that projected energy savings are higher than the increase in monthly mortgage payments. The loan is from a private lender and a portion is guaranteed by the VA.

Who qualifies

Qualified military personnel, members of the reserves and veterans. Applicants must also provide a certificate of eligibility from a lending office to a private lender approved by the Department of Veterans Affairs.

What it covers

A variety of energy efficiency measures, including solar cooling and heating systems and any other improvements that the lender agrees will help lower utility costs.

What’s the benefit

Homeowners don’t have to complete an additional appraisal, and the VA insures 50 percent of the loan.

How the mortgage works

Rather than being backed by a federal agency, private lenders sell loans to Fannie Mae and Freddie Mac. These loans allow homebuyers to borrow a maximum of 15 percent of the appraisal value of an existing home. Fannie Mae also provides up to 5 percent for new homes certified by Energy Star.

Who qualifies

Individuals who may not otherwise qualify based on their income; homebuyers looking to purchase an Energy Star-approved home.

What it covers

Conventional EEMs are typically used to purchase a new home that already meets an energy efficiency rating, but they also offer financing for home improvements on an existing home.

What’s the benefit

These loans increase the purchasing power of buyers, crediting a home’s energy efficiency rating and allowing the lender to increase the borrower’s income by an amount equal to the projected energy savings.

U.S. Clean Energy Rule:

Regulating Emissions

In June of 2019, the Environmental Protection Agency finalized the Affordable Clean Energy (ACE) Rule. The rule repeals and replaces the Obama administration’s Clean Power Plan which was never put into effect due to Supreme Court Intervention.

ACE is an emission guideline that uses heat rate improvement (HRI) as the Best System of Emission Reduction (BSER) for CO2 from a coal-fired electric generating unit (EGU). The emission guidelines are focused solely on designated facilities defined as coal-fired EGUs with a capacity greater than 25 MW-net and commenced construction on or before January 8, 2014. There are approximately 600 EGUs at 300 facilities that could be covered by this rule.

States are then required to develop and submit their plans to regulate emissions in accordance with ACE guidelines for EPA review and approval.

In 2030, the ACE rule is projected to:

Reduce CO2 emissions by 11 million short tons

Reduce SO2 emissions by 5,700 tons

Reduce NOx emissions by 7,100 tons

Reduce PM2.5 emissions by 400 tons

Reduce mercury emissions by 59 pounds

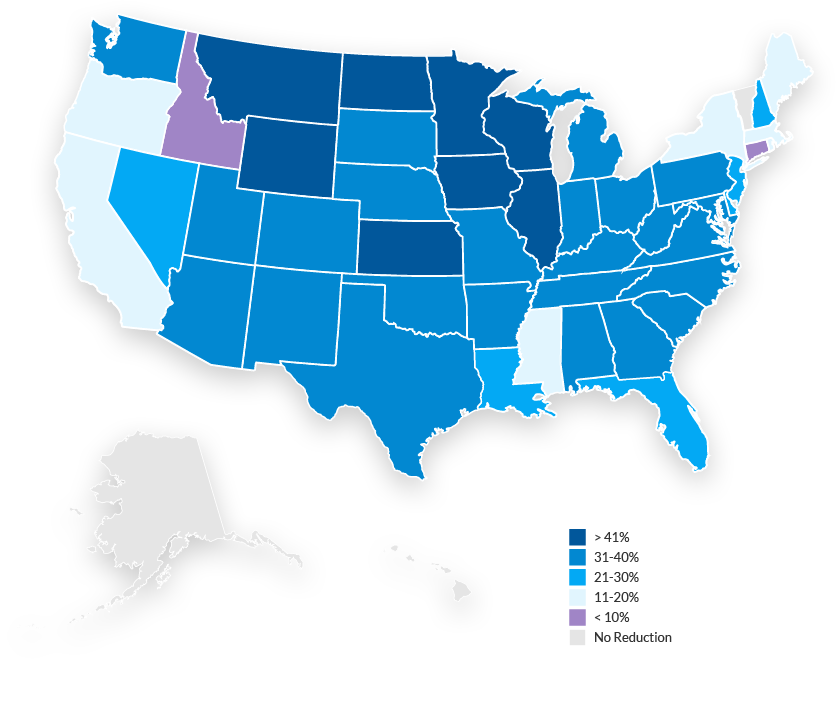

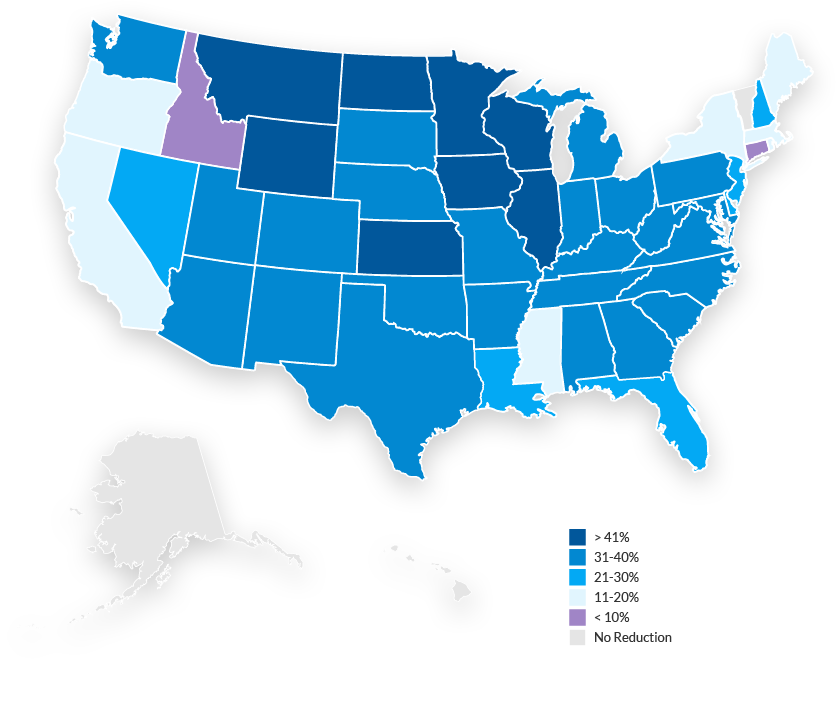

Clean Power Plan 2030 Proposed Emission Reductions

(from 2012 levels)

Source: National Conference of State Legislatures